Closing: Jul 10, 2024

9 days remainingPublished: Jun 27, 2024 (5 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

This role is responsible for evaluation and identification of the areas of potential financial risks threatening Loop DFS Group assets, earning capacity, or success of the organization, by performing financial analysis and validation activities with the objective of maximizing profits and asset growth, whilst minimizing operating losses and other risk exposures.

They are also responsible for developing business intelligence dashboards to inform decision-making and facilitate risk monitoring, and provide financial modeling to assess and predict profitability and performance of consumer, merchant and corporate products and/or services. They are also responsible for creating financial reports based on the impact of predictive modeling assumptions as well as developing various financial models and providing cost-benefit analyses for business and strategic opportunities, market share, and profitability.

The role is critical for executing underwriting operations, including evaluation of credit risk proposals and recommending credit decisions and conditions for success for the consumer and merchant businesses across all markets where Loop DFS is represented, in a manner that drives and optimizes lending margins in alignment with the Group’s Risk Appetite and Business objectives.

SME in market research, financial and credit risk underwriting process design and assessment techniques in a highly digital and data driven environment, and will assist Senior Manager to guide other Loop DFS Units in their roles and responsibilities in a manner that optimizes business margins.

JOB SPECIFICATIONS

Academic:

- University degree preferably in Actuarial Science, Statistics, Economics, Finance or Business Administration or related fields.

- Proficiency and Practical experience in data analytics and use of relevant MIS, BI & MS Office applications and statistical computer languages e.g. SQL, R, Python.

- Strong IT skills and experience with office automation tools

Desired work experience:

- At least 4 years banking experience with at least 2 years covering credit management, financial risk and/or portfolio analysis.

- Experience with risk management and reporting in a highly automated environment with Big data analytics will be an added advantage.

Responsibilities

This role is responsible for evaluation and identification of the areas of potential financial risks threatening Loop DFS Group assets, earning capacity, or success of the organization, by performing financial analysis and validation activities with the objective of maximizing profits and asset growth, whilst minimizing operating losses and other risk exposures.

They are also responsible for developing business intelligence dashboards to inform decision-making and facilitate risk monitoring, and provide financial modeling to assess and predict profitability and performance of consumer, merchant and corporate products and/or services. They are also responsible for creating financial reports based on the impact of predictive modeling assumptions as well as developing various financial models and providing cost-benefit analyses for business and strategic opportunities, market share, and profitability.

The role is critical for executing underwriting operations, including evaluation of credit risk proposals and recommending credit decisions and conditions for success for the consumer and merchant businesses across all markets where Loop DFS is represented, in a manner that drives and optimizes lending margins in alignment with the Group’s Risk Appetite and Business objectives.

SME in market research, financial and credit risk underwriting process design and assessment techniques in a highly digital and data driven environment, and will assist Senior Manager to guide other Loop DFS Units in their roles and responsibilities in a manner that optimizes business margins.

JOB SPECIFICATIONS

Academic:

- University degree preferably in Actuarial Science, Statistics, Economics, Finance or Business Administration or related fields.

- Proficiency and Practical experience in data analytics and use of relevant MIS, BI & MS Office applications and statistical computer languages e.g. SQL, R, Python.

- Strong IT skills and experience with office automation tools

Desired work experience:

- At least 4 years banking experience with at least 2 years covering credit management, financial risk and/or portfolio analysis.

- Experience with risk management and reporting in a highly automated environment with Big data analytics will be an added advantage.

Financial (30%)

- Establish and review risk tolerance thresholds based on Loop DFS strategy, Risk Appetite, manage and escalate exceptions to guard the Group against unacceptable financial and credit losses arising from breach of KRIs.

- Generate and review risk measures including Cost of Risk and NPL levels

- Generate and review income simulation to ensure the Group’s risk/return/dividend targets and goals are met; and provide support for model and report enhancements.

- Monitoring covenant compliance and account performance to ensure risk stays within agreed thresholds.

- Monitor key portfolio performance trends to ensure strong credit portfolio quality with a good balance of risk and reward to optimize business opportunities, and in line with business strategy and risk appetite.

Internal Business Processes (50%)

- Conduct continuous market, economic, environmental, social and governance (regulatory)research to assess and advice the severity of financial risk within the Group

- Establish strategies for managing risk exposure by identifying potential problems or opportunities and developing solutions.

- Validate and refine various financial and credit policies/processes through use of analytics

- Identify, Analyze & articulate risks associated with new products or services in Merchant & Consumer businesses to ensure that they are financially viable

- Present ideas as outcomes of risk evaluation exercises via reports and presentations, outline findings and make recommendations for improvements.

- Support new business initiatives through use of quantitative (statistical) using software such as R, Python and qualitative analysis to evaluate risk.

- Conduct periodic evaluations and quality assessments to ensure that the Group’s financial systems and processes are functioning properly

- Using background due diligence to evaluate credit risk, and propose creation of customized credit products to tailor needs of the Business and Customer segments

- Interact directly and maintain good rapport with Business teams and customers teams to deeply understand their business models while protecting the Group’s interests and following compliance protocols

- Guide and support pre-underwriting functions (Business/Data Science/Product) in determining correct application of Loop DFS guidelines.

- Keep abreast on latest technology changes such as data analytics and artificial intelligence that can be applied to financial and credit risk management.

- Recognize and escalate decisions to the Senior Manager when required as per underwriting policy

- Perform ad-hoc creation and maintenance of reports related to underwriting operations

- Perform regular risk control assessments, scenario analysis and stress tests on the loan portfolio within agreed service levels

- Collaborate widely with other stakeholders in the Group and its subsidiaries in key digital initiatives, including risk process design, development and execution of tests

- Assess the effectiveness and accuracy of new data sources and data gathering techniques in collaboration with Data Engineering and Data science.

- Perform financial forecasting, reporting, and operational metrics tracking

- Design, develop and implement financial models for decision support including predictive modelling to increase and optimize collections and recoveries, customer experiences, revenue generation, ad targeting and other business outcomes.

- Analyze past results, perform variance analysis, identify trends, and make recommendations for improvements

- Support scorecard monitoring and analysis; participate in the scorecard development as well as validation of the score cut-off points.

- Guide the cost analysis process by establishing and enforcing policies and procedures

- Perform market research, data mining, business intelligence, and valuation computations

- Satisfactory Audit/Risk and compliance rating on data driven models and underwriting processes.

Customer (10%)

- Work in close collaboration with the Business Teams to achieve the following for assigned portfolios:

- Support New Business initiatives & proposals for incorporation into product programs

- Engage Business partners in regular asset quality reviews with provision of analytics insights to identify risks/ opportunities and recommend relevant actions

- Support review of credit policies, scorecards and program risk acceptance criteria regularly, with analytical insights of portfolio trends & performance

- Drive portfolio management, collections and recoveries initiatives through the credit cycle management framework by jointly working in partnership with business, product managers, data science team, operations team and collection teams

- Support New Business initiatives & proposals for incorporation into product programs

- Support scorecard monitoring and analysis; involve in the scorecard development, back testing as well as validation of the score cut-off.

- Participate in digital initiatives and drive continuous improvements in analytics capabilities using both traditional and non-traditional data as well as enhancements in the use of risk analytics tools.

Learning and Development (20%)

- Self-development: engage in self-development initiatives and trainings that equip staff on emerging global Risk management practices

- Subsidiary staff growth and transfer of best practices skills through regular training and coaching

- Internal Staff growth through coaching and training.

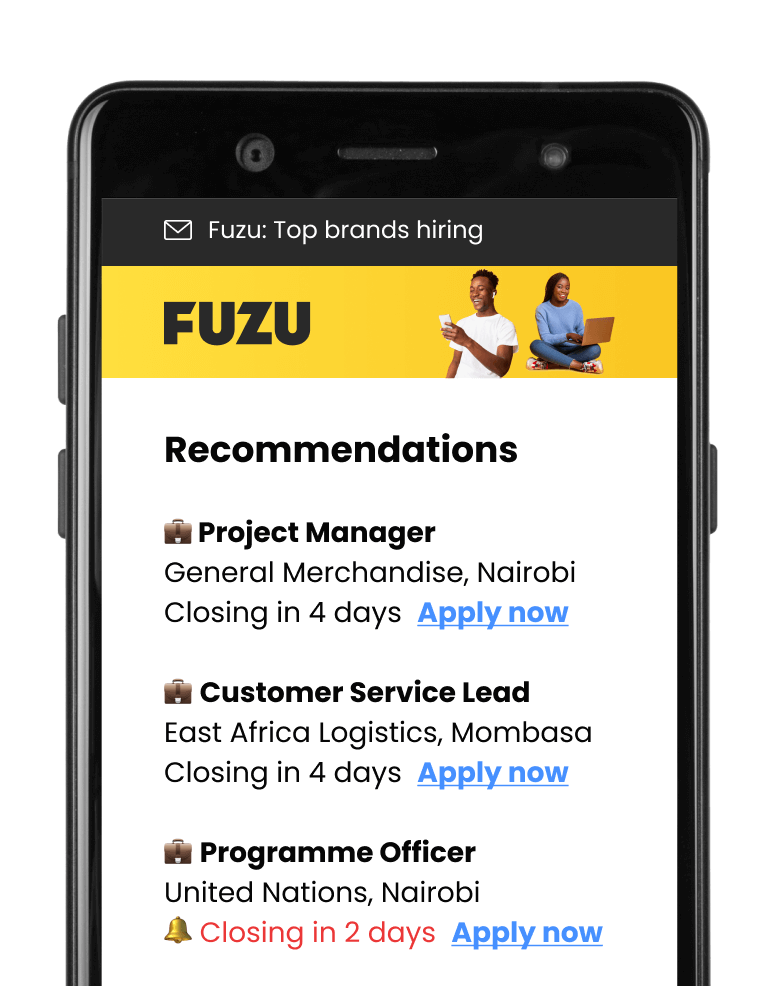

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.