Closing: Jul 5, 2024

6 days remainingPublished: Jun 26, 2024 (3 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

The purpose of this job is to support the LOOP DFS Risk Management and Compliance function through the implementation of the Compliance Framework within the standards defined by the Group including the identification, measurement, monitoring and reporting of risk and enforcing Compliance with policies, processes, procedures and controls.

The role of the Compliance Specialist is to analyze risk data that is collected from various sources, including risk registers, incident reports, and audit findings and be capable of using analytical tools to identify trends and patterns in the data to assess the overall Compliance risk landscape. This role is responsible for ensuring regulatory and policy compliance to all applicable laws, regulations, policies and standards that impact LOOP DFS.

JOB COMPETENCIES

Technical Competencies

- A risk, Compliance or audit related professional Certification such as, CFE, Compliance, KYC, CFE is highly desirable.

- A good understanding of all core processes and knowledge of regulatory and statutory requirements.

- Strong financial modelling, analytical and problem-solving skills with an emphasis on data science and risk management.

- Experience working with and ideation and creation of data architectures.

- Knowledge of a variety of machine learning techniques (clustering, decision tree learning, artificial neural networks, etc.) and their real-world advantages/drawbacks.

- Knowledge of advanced statistical techniques and concepts (regression, properties of distributions, statistical tests, Poisson distribution and proper usage, etc.) and experience with applications.

- Excellent written and verbal communication skills for coordinating cross functional teams.

- Proficiency in ISO 9001 2015 is highly desired in regards to Quality Management System.

- Risk Assessment and Identification - knowledge of the financial sector and risk management guidelines as well as current banking and fintech operations practice.

- Risk Management Design - Deep familiarity with digital banking and payments products and the relevant business processes

Behavioural Competencies

- Excellent planning and organizational skills with ability to breakdown complex items to actionable elements.

- Relate easily and naturally with executives, business managers, technical teams and customers. Has excellent listening skills and understands the desires and challenges of all our leaders and customers.

- Able to change plans, methods, opinions or goals in light of new information, with the readiness to act on opportunities. Highly effective in adapting to differing environments.

- Capable of developing a sound understanding of the motives, needs and concerns of others and develop a deep understanding of their complex stakeholder network. Can anticipate the motives and expectations of others effectively.

- Self-motivated and self-managing.

Responsibilities

The purpose of this job is to support the LOOP DFS Risk Management and Compliance function through the implementation of the Compliance Framework within the standards defined by the Group including the identification, measurement, monitoring and reporting of risk and enforcing Compliance with policies, processes, procedures and controls.

The role of the Compliance Specialist is to analyze risk data that is collected from various sources, including risk registers, incident reports, and audit findings and be capable of using analytical tools to identify trends and patterns in the data to assess the overall Compliance risk landscape. This role is responsible for ensuring regulatory and policy compliance to all applicable laws, regulations, policies and standards that impact LOOP DFS.

JOB COMPETENCIES

Technical Competencies

- A risk, Compliance or audit related professional Certification such as, CFE, Compliance, KYC, CFE is highly desirable.

- A good understanding of all core processes and knowledge of regulatory and statutory requirements.

- Strong financial modelling, analytical and problem-solving skills with an emphasis on data science and risk management.

- Experience working with and ideation and creation of data architectures.

- Knowledge of a variety of machine learning techniques (clustering, decision tree learning, artificial neural networks, etc.) and their real-world advantages/drawbacks.

- Knowledge of advanced statistical techniques and concepts (regression, properties of distributions, statistical tests, Poisson distribution and proper usage, etc.) and experience with applications.

- Excellent written and verbal communication skills for coordinating cross functional teams.

- Proficiency in ISO 9001 2015 is highly desired in regards to Quality Management System.

- Risk Assessment and Identification - knowledge of the financial sector and risk management guidelines as well as current banking and fintech operations practice.

- Risk Management Design - Deep familiarity with digital banking and payments products and the relevant business processes

Behavioural Competencies

- Excellent planning and organizational skills with ability to breakdown complex items to actionable elements.

- Relate easily and naturally with executives, business managers, technical teams and customers. Has excellent listening skills and understands the desires and challenges of all our leaders and customers.

- Able to change plans, methods, opinions or goals in light of new information, with the readiness to act on opportunities. Highly effective in adapting to differing environments.

- Capable of developing a sound understanding of the motives, needs and concerns of others and develop a deep understanding of their complex stakeholder network. Can anticipate the motives and expectations of others effectively.

- Self-motivated and self-managing.

Internal Processes (70%)

- Develop and maintain models and tools used to predict Compliance potential losses from various types of risks.

- Develop and implement new risk management strategies and tools that help reduce Compliance risks exposure and maximize profits.

- Collaborate with LDFS Commercial Team, Operations teams, Engineering, Business performance, Product and Delivery Management on ways to set appropriate Compliance controls, internal alerts and to mitigate Compliance Risk.

- Engage with risk owners and the wider business to promote risk management practices and culture across their respective areas.

- Develop key risk and control indicators to identify and control Compliance Risk.

- Monitor the health of the organization in order to proactively detect and address vulnerabilities.

- Assist with the maintenance of the Compliance risk register for all Business and Subsidiary Units.

- Support in the management of the Compliance Risk assessment process for circulation to relevant Committee.

- Conduct a comprehensive assessment of existing control processes and procedures and identify potential control gaps and weaknesses.

- Follow up on Closing of Compliance audit findings, Internal Audit and Independent reviews and liaising with other functions to ensure that Compliance related audit findings are satisfactorily closed.

- Advice senior management on Compliance trends and exposures LOOP DFS is experiencing and provide recommendations to minimize the risk. Provide expert guidance and training to staff on policies and procedures compliance

- Support the establishment of the complete Compliance scope for LOOP DFS based on applicable laws, regulations, policies and related policy standards and policy guidelines, and aim at achieving 100% Compliance

- Conducting regular evaluations of the effectiveness of risk management policies and procedures to ensure they are meeting the organization’s objectives.

- Support the Risk Manager in the reporting of Compliance risks to the relevant committees.

- Understand and implement regulatory requirements: Develop policies and procedures to ensure Compliance with various regulations.

- Lead on FATCA & CRS compliance by ensuring that various functions are informed of their responsibilities, due diligence is conducted on US & CRS indicia customers and necessary reports are filed with the Internal Revenue Service (IRS) and the Local Taxman.

- Coordination of the Incident Management and Crisis Management Team(IMT).

- Coordinate activities of the Risk Champions across LDFS Units

Customer (10%)

- Turnaround time standards or benchmarks for decisions on Project development targets and applications that support a customer obsessed culture i.e. Service Level Agreement (SLA) / Turn-Around Time (TAT) and Customer Satisfaction Index (CSI) benchmarks.

Learning and Development (20%)

- Risk Culture - Continuously researching and improving the operational risk process, governance and capabilities and drive awareness amongst the LDFS staff through day to day risk management support and education, in collaboration with Risk Champions

- Drive competency focus through continuous learning and job enrichment to ensure high performance.

JOB SPECIFICATIONS

Academic:

- University degree preferably in Actuarial Science, Statistics, Economics, Finance or Business Administration or related fields.

- Proficiency and Practical experience in data analytics and use of relevant MIS, BI & MS Office applications and statistical computer languages e.g. SQL, R, Python.

- Strong IT skills and experience with office automation tools

Desired work experience:

- At least 5 years banking experience with at least 2 years covering Compliance risk management.

- Experience with risk management and reporting in a highly automated environment with Big data analytics will be an added advantage.

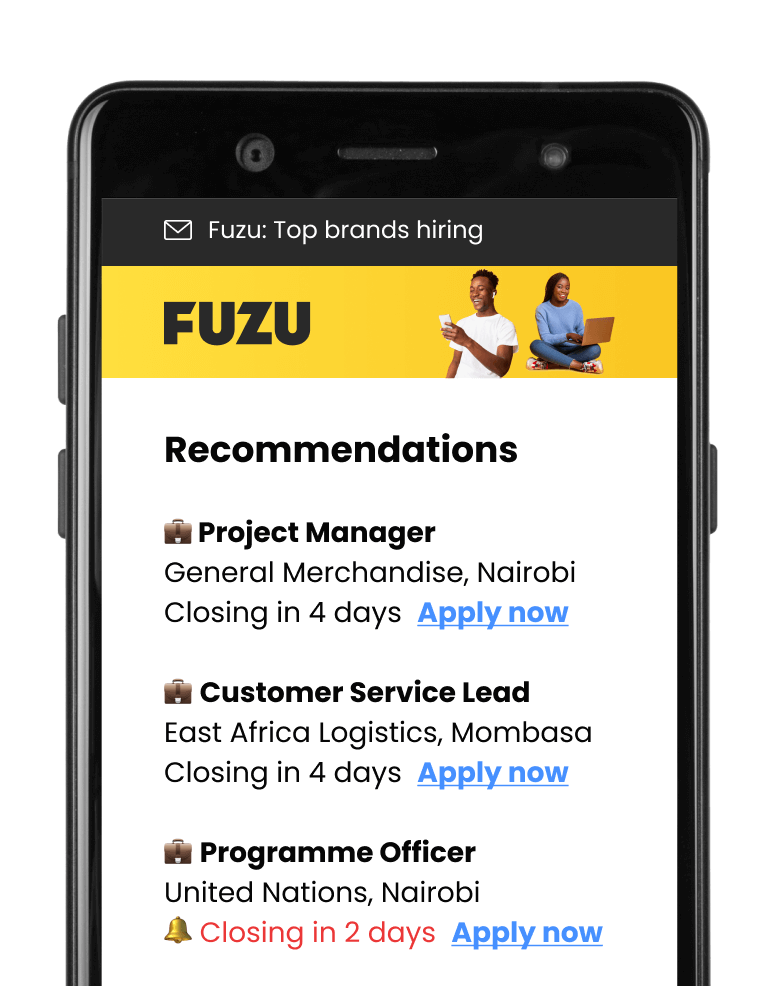

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.