Closing: Jul 15, 2024

9 days remainingPublished: Jun 21, 2024 (16 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

QUALIFICATIONS AND EXPERIENCE

- A Bachelor’s Degree in a business-related field from a recognized University with at least five (5) years working experience in banking or in a financial institution.

- Professional qualifications will be an added advantage.

- Good knowledge of mortgage product and mortgage sales experience with a good appreciation of legal processes in conveyance/ land matters

- Proactive, assertive and highly adaptable to change with strong analytical skills and customer centric mindset.

- Personal organization and thoroughness coupled with the ability to work under minimum supervision with good Judgment skills.

- Ability to analyze data, information and situations for effective work performance with excellent attention to details and quality output.

Interested candidates who meet the set criteria may submit their Application Letter together with their detailed CV, Copy of I.D, Copies of Academic & Professional Certificates, Names and Contacts of three referees to [email protected] clearly indicating the position applied for with the job reference number on or before July 15th 2024.

Applications that are incomplete, received after the due date or that do not meet the stated requirements will not be considered. Hard Copy Documents will not be accepted. Canvassing Will Lead to Automatic Disqualification. Only Shortlisted Candidates Will Be Contacted.

THE SUCCESSFUL CANDIDATE MUST FULFILL THE REQUIREMENTS OF CHAPTER SIX OF THE CONSTITUTION OF KENYA 2010 BELOW:

- Valid Certificate of Good Conduct from the Directorate of Criminal Investigations

- Clearance Certificate from the Higher Education Loans Board/Compliance Certificate

- Tax Compliance Certificate from KRA

- Clearance from Ethics and Anti-Corruption Commission

- A Clearance Certificate from an approved Credit Reference Bureau CRB

Responsibilities

QUALIFICATIONS AND EXPERIENCE

- A Bachelor’s Degree in a business-related field from a recognized University with at least five (5) years working experience in banking or in a financial institution.

- Professional qualifications will be an added advantage.

- Good knowledge of mortgage product and mortgage sales experience with a good appreciation of legal processes in conveyance/ land matters

- Proactive, assertive and highly adaptable to change with strong analytical skills and customer centric mindset.

- Personal organization and thoroughness coupled with the ability to work under minimum supervision with good Judgment skills.

- Ability to analyze data, information and situations for effective work performance with excellent attention to details and quality output.

Interested candidates who meet the set criteria may submit their Application Letter together with their detailed CV, Copy of I.D, Copies of Academic & Professional Certificates, Names and Contacts of three referees to [email protected] clearly indicating the position applied for with the job reference number on or before July 15th 2024.

Applications that are incomplete, received after the due date or that do not meet the stated requirements will not be considered. Hard Copy Documents will not be accepted. Canvassing Will Lead to Automatic Disqualification. Only Shortlisted Candidates Will Be Contacted.

THE SUCCESSFUL CANDIDATE MUST FULFILL THE REQUIREMENTS OF CHAPTER SIX OF THE CONSTITUTION OF KENYA 2010 BELOW:

- Valid Certificate of Good Conduct from the Directorate of Criminal Investigations

- Clearance Certificate from the Higher Education Loans Board/Compliance Certificate

- Tax Compliance Certificate from KRA

- Clearance from Ethics and Anti-Corruption Commission

- A Clearance Certificate from an approved Credit Reference Bureau CRB

JOB REF:YSL/CA-2/2024ROLES AND RESPONSIBILITIES

- Review projects in property development suitable for financing bearing in mind risk/return parameters set by the Sacco;

- Monitor in collaboration with the Sacco business and credit risk units, progress on project implementation;

- Monitor the financial and operational performance of projects for early identification of potential problems as well as initiate timely remedial actions;

- Generate various management reports on performance of the construction loan portfolio;

- Handle enquiries from prospective clients that sometimes involve preliminary site visits with the RMS/PSMs;

- Provide guidance for the purposes of re-packaging construction/project cases to meet banks requirement;

- Review Sacco new applications for funding submitted from the department, business units or our branch network;

- Initiating projects disbursement memos for review by the Technical team as per the laid down policies and procedures;

- Benchmark the competition and advising on new product offerings and maintaining a project comparable database to assist the business in project analysis and respond to customer product complaints especially during project implementation;

- Maintain construction project files, that relate to customer correspondence, work in progress, approved credit request and general correspondence as well as project processing and administration;

- Conduct pre-appraisal reviews and communicating the findings to the business development manager and prospective clients;

- Review submitted project documentation that includes but not limited to titles, approved architectural drawings, structural drawings, NEMA approvals/Licenses;

- Conduct initial review of technical documents with a view to advice on their adequacy to proceed to technical review;

- Review offer letter terms and conditions to ensure they in tandem with the envisioned mode of project implementation;

- Review submitted interim valuations before initiating disbursements requests;

- Hold meetings with clients. consultants to address issues on proposed construction projects;

- Conduct periodical site visits to asses projects and hold discussion with concerned parties together with the project managers;

- Undertake detailed appraisal report for review by the team leader and work in conjunction with the business units and project managers to write supervision reports that asses critical parameters at implementation stage;

- Work together with various business units and the project managers to address issues arising out of the outcome of the supervision at implementation stage and monitor performance of the project;

- Ensure that all risk management requirements within your remit are addressed and where necessary escalated through the available defined channels;

- Conduct post implementation review on projects and record key learning points for dissemination with a view to improving on the Sacco processing procedures and risk management;

- Ensure strict adherence to all regulations, statutes, standards, practices and all internal processes and procedures as per the relevant manuals and comply with all relevant external legislation and regulations with regard to Compliance requirements.

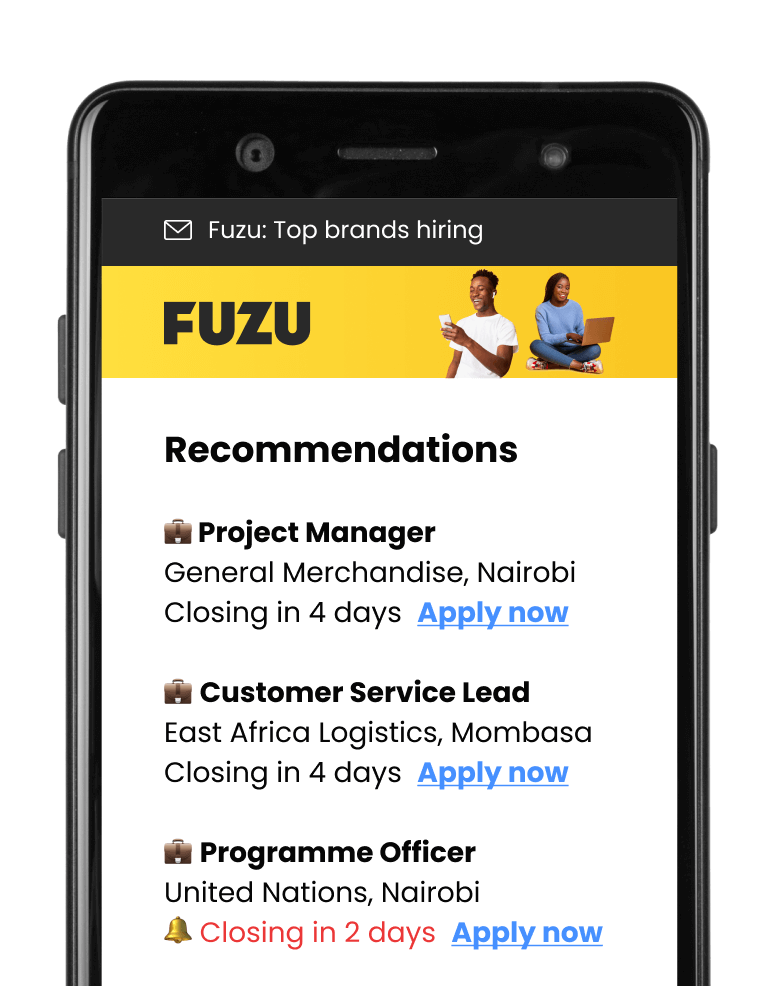

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.