Closing: Jul 15, 2024

9 days remainingPublished: Jun 21, 2024 (16 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

QUALIFICATIONS AND EXPERIENCE

- Bachelor’s degree in Cooperative Management or Commerce or its equivalent from a recognized university;

- Have experience in Credit Operations or Debt Collection in Yetu Sacco or like organizations for at least (3) years

- Qualifications in Accounting or Finance are an added advantage;

- Good interpersonal & communication skills with excellent customer service;

- A team player with the drive to improve performance;

- Self-driven and possess the ability to work with minimum supervision;

- A high degree of integrity and commitment.

Interested candidates who meet the set criteria may submit their Application Letter together with their detailed CV, Copy of I.D, Copies of Academic & Professional Certificates, Names and Contacts of three referees to [email protected] clearly indicating the position applied for with the job reference number on or before July 15th 2024.

Applications that are incomplete, received after the due date or that do not meet the stated requirements will not be considered. Hard Copy Documents will not be accepted. Canvassing Will Lead to Automatic Disqualification. Only Shortlisted Candidates Will Be Contacted.

THE SUCCESSFUL CANDIDATE MUST FULFILL THE REQUIREMENTS OF CHAPTER SIX OF THE CONSTITUTION OF KENYA 2010 BELOW:

- Valid Certificate of Good Conduct from the Directorate of Criminal Investigations

- Clearance Certificate from the Higher Education Loans Board/Compliance Certificate

- Tax Compliance Certificate from KRA

- Clearance from Ethics and Anti-Corruption Commission

- A Clearance Certificate from an approved Credit Reference Bureau CRB

Responsibilities

QUALIFICATIONS AND EXPERIENCE

- Bachelor’s degree in Cooperative Management or Commerce or its equivalent from a recognized university;

- Have experience in Credit Operations or Debt Collection in Yetu Sacco or like organizations for at least (3) years

- Qualifications in Accounting or Finance are an added advantage;

- Good interpersonal & communication skills with excellent customer service;

- A team player with the drive to improve performance;

- Self-driven and possess the ability to work with minimum supervision;

- A high degree of integrity and commitment.

Interested candidates who meet the set criteria may submit their Application Letter together with their detailed CV, Copy of I.D, Copies of Academic & Professional Certificates, Names and Contacts of three referees to [email protected] clearly indicating the position applied for with the job reference number on or before July 15th 2024.

Applications that are incomplete, received after the due date or that do not meet the stated requirements will not be considered. Hard Copy Documents will not be accepted. Canvassing Will Lead to Automatic Disqualification. Only Shortlisted Candidates Will Be Contacted.

THE SUCCESSFUL CANDIDATE MUST FULFILL THE REQUIREMENTS OF CHAPTER SIX OF THE CONSTITUTION OF KENYA 2010 BELOW:

- Valid Certificate of Good Conduct from the Directorate of Criminal Investigations

- Clearance Certificate from the Higher Education Loans Board/Compliance Certificate

- Tax Compliance Certificate from KRA

- Clearance from Ethics and Anti-Corruption Commission

- A Clearance Certificate from an approved Credit Reference Bureau CRB

- Processing, appraising of loan applications and ensuring that all the necessary support documentation (i.e. Insurances, tracking Certificates, licenses, certifications, statutory and constitutional documents) are received from clients and are current, valid and correctly stored in credit files.

- Ensuring loans are closed in compliance with the loan terms and policy and are properly booked in the core banking system.

- Preparing along with the Head of Credit the credit proposals for presentation and consideration by the credit committee;

- Security perfection of both properties and Motor vehicles i.e.; for motor vehicles must ensure joint registration and for property charge of property before disbursement;

- Offering members with alternative solutions if they cannot qualify for the applied loan;

- Discharging of collaterals after successful clearance of loans;

- Responsible for letters of offer execution;

- Maintaining confidentiality of members loan information;

- Ensuring compliance with the credit policy and procedures of the Sacco and co-ordinating efforts together with the Branches to ensure adherence to the Credit Policy and lending guidelines;

- Ensuring high turnaround time (TAT) for Credit proposals;

- Analyzing periodic monitoring reports from designated clients, third party monitors and discuss with the Head of Credit;

- Ensuring that all appraisal decisions meet the agreed SLA;

- Ensuring all disbursed loans are forwarded in time;

- Management of credit risks through analysis and recommend approvals for facilities within the Institutions tolerable risk levels;

- Co-ordinating enforcement of sanction conditions and risk mitigation strategies;

- Credit monitoring and portfolio analysis;

- Ensuring proper reporting, documentation and review to determine that lending to the respective segments is within acceptable risk;

- Assisting in reviewing and analyzing all new loans from Branches and provide timely recommendations;

- Any other lawful duty as may be assigned from time to time.

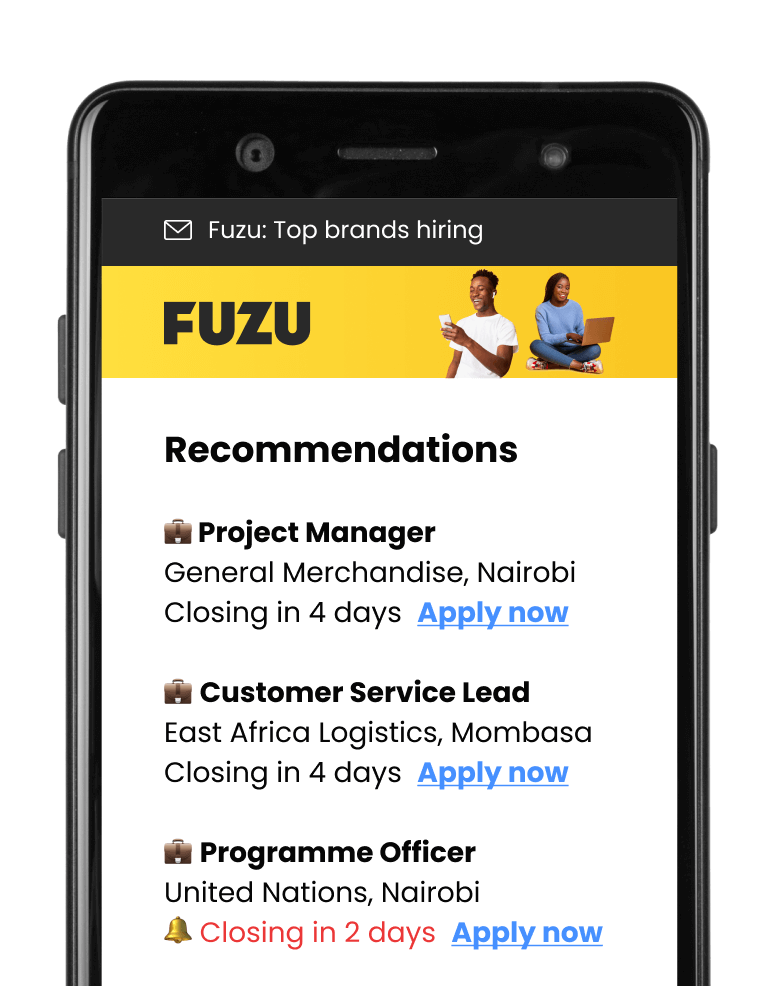

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.