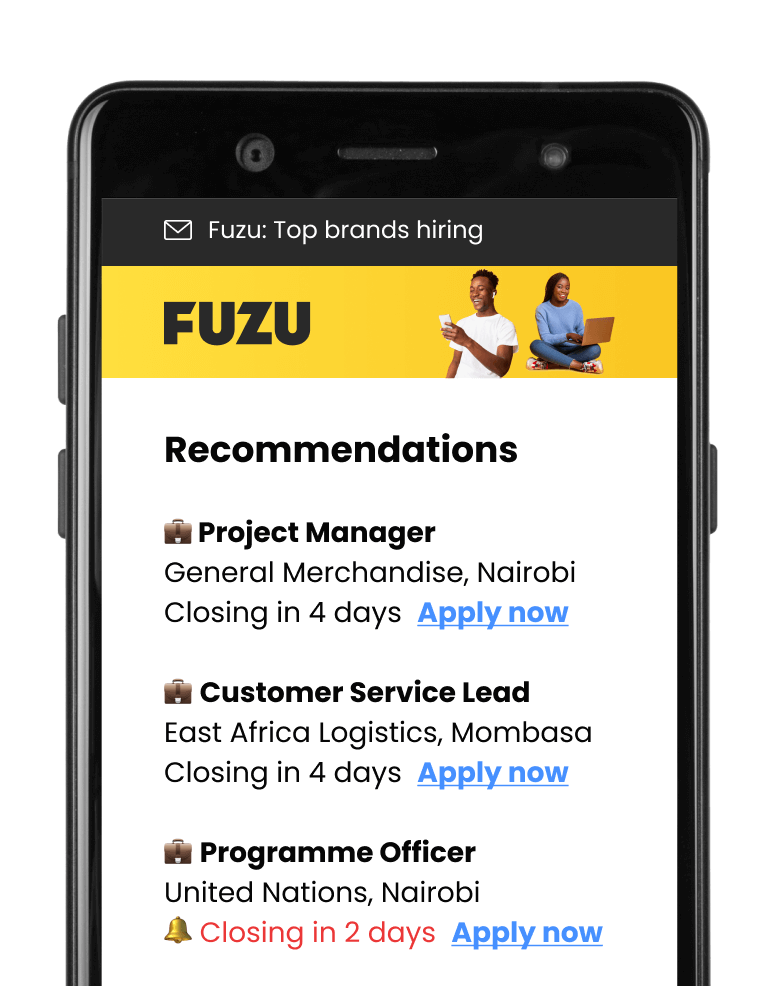

Jobs in NigeriaJobs in UgandaJobs in KenyaJobs in Lagos NigeriaJobs in Abuja NigeriaJobs in Portharcourt NigeriaJobs in Kaduna NigeriaJobs in Asaba NigeriaJobs in Ibadan NigeriaJobs in Kano NigeriaJobs in Onitsha NigeriaJobs in Owerri NigeriaJobs in Ilorin NigeriaJobs in Benin City NigeriaJobs in Nasarawa NigeriaJobs in Oyo NigeriaJobs in Yola NigeriaJobs in Jos NigeriaJobs in Gombe NigeriaJobs in Awka NigeriaJobs in Aba NigeriaJobs in Kampala UgandaJobs in Gulu UgandaJobs in Entebbe UgandaJobs in Nairobi KenyaJobs in Muranga Kenya

Published

Last 1 week

Last 30 days

Latest 24 hours

Profession