Closing: May 17, 2024

Closing todayPublished: May 2, 2024 (15 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

What You Should Have

- Bachelor's degree in Finance, Accounting, or a related field (CPA or similar qualification a plus).

- Minimum of 3 years' experience in a treasury role, preferably within a regulated financial institution or the remittance industry.

- Demonstrated understanding of relevant regulations, particularly those related to financial reporting, AML/CFT, and remittance activities.

- Proficiency in Microsoft Office Suite and accounting software.

- Experience with remittance-specific software is a plus.

- Strong analytical and problem-solving skills with the ability to identify and address financial risks.

- Excellent attention to detail and accuracy.

- Superior communication and interpersonal skills, with the ability to collaborate effectively with internal and external stakeholders.

Responsibilities

What You Should Have

- Bachelor's degree in Finance, Accounting, or a related field (CPA or similar qualification a plus).

- Minimum of 3 years' experience in a treasury role, preferably within a regulated financial institution or the remittance industry.

- Demonstrated understanding of relevant regulations, particularly those related to financial reporting, AML/CFT, and remittance activities.

- Proficiency in Microsoft Office Suite and accounting software.

- Experience with remittance-specific software is a plus.

- Strong analytical and problem-solving skills with the ability to identify and address financial risks.

- Excellent attention to detail and accuracy.

- Superior communication and interpersonal skills, with the ability to collaborate effectively with internal and external stakeholders.

Job Overview

- We are seeking a highly motivated and experienced Treasurer to join our dynamic team.

- In this critical role, you will be responsible for safeguarding company assets, overseeing all financial transactions, and ensuring strict adherence to FCA regulations specific to the remittance industry.

- You possess a strong financial acumen and passion for ensuring financial security in a fast-paced, highly regulated environment.

- The successful candidate is an analytical and detail-oriented individual with a desire to contribute to the success of a growing FCA-regulated remittance company.

What You Will Do

Safeguarding Company Assets:

- Oversee the safekeeping of company cash, investments, and other financial assets.

- Manage bank accounts, credit cards, and other financial instruments used for remittance activities.

- Implement and maintain robust internal controls to mitigate financial risks, particularly those associated with money laundering and terrorist financing.

Transaction Management:

- Oversee all domestic and international remittance transactions, ensuring accuracy, compliance with relevant regulations, and timely completion.

- Manage currency exchange rates and associated risks.

- Liaise with partner financial institutions and relevant authorities to facilitate smooth and secure transactions.

Regulatory Compliance:

- Stay up-to-date on the latest regulations pertaining to financial reporting, anti-money laundering (AML), counter-terrorism financing (CFT), and remittance activities.

- Ensure all financial activities comply with relevant regulations, internal policies, and industry best practices.

- Develop and implement internal procedures to mitigate compliance risks and maintain a strong compliance culture within the company.

- Advise senior management on the implications of new or existing regulations and potential impacts on remittance operations.

Financial Reporting and Analysis:

- Prepare and present timely and accurate financial reports to senior management and the Board of Directors, ensuring transparency and accountability.

- Analyze financial data to identify trends, assess risks, and support informed decision-making.

- Contribute to the development and implementation of financial strategies aligned with the company's growth objectives.

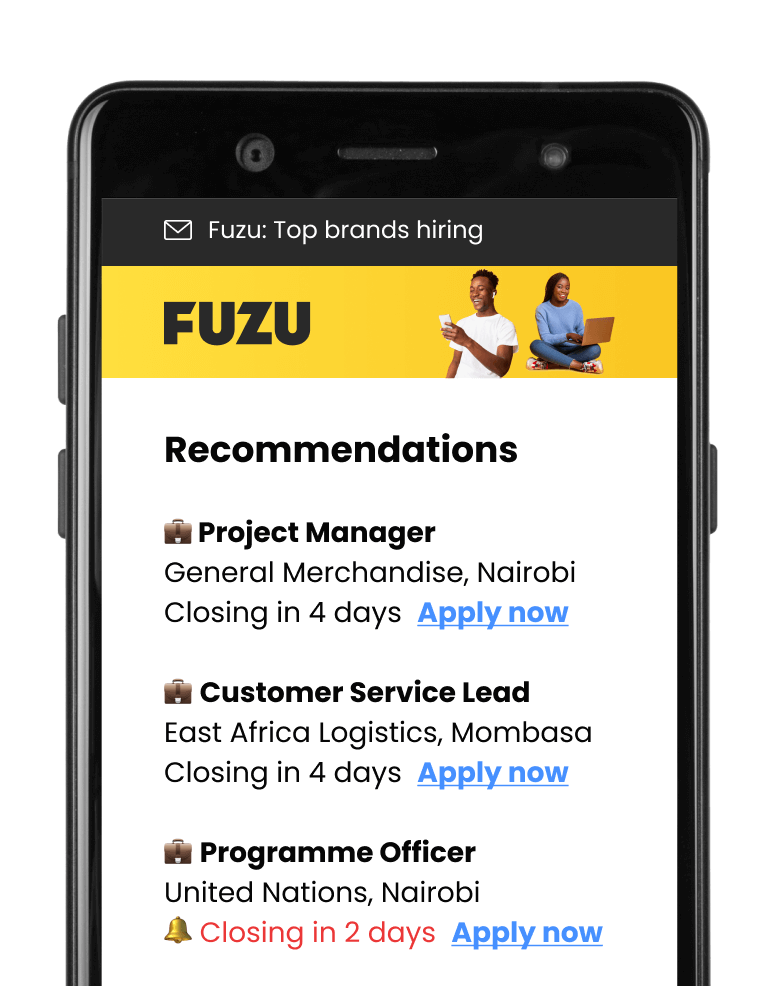

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.