Closing: May 22, 2024

5 days remainingPublished: May 1, 2024 (16 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

Requirements

- Bachelor's or Master's degree in Finance, Business Administration, Economics, or a related field.

- 2 + years of experience in Investment Banking, private equity, venture capital, or corporate finance, with a focus on project finance, infrastructure, or sustainable investments.

- Strong analytical skills, with proficiency in financial modeling, valuation techniques, and investment analysis.

- Excellent research and due diligence capabilities, with the ability to gather, analyze, and interpret complex information from multiple sources.

- Strong communication and presentation skills, with the ability to articulate ideas and recommendations effectively to internal and external stakeholders.

- Ability to work independently and collaboratively in a fast-paced, dynamic environment, with a strong attention to detail and ability to manage multiple projects simultaneously.

- Passion for transformative projects and a commitment to advancing environmental and social well-being in Africa.

Responsibilities

Requirements

- Bachelor's or Master's degree in Finance, Business Administration, Economics, or a related field.

- 2 + years of experience in Investment Banking, private equity, venture capital, or corporate finance, with a focus on project finance, infrastructure, or sustainable investments.

- Strong analytical skills, with proficiency in financial modeling, valuation techniques, and investment analysis.

- Excellent research and due diligence capabilities, with the ability to gather, analyze, and interpret complex information from multiple sources.

- Strong communication and presentation skills, with the ability to articulate ideas and recommendations effectively to internal and external stakeholders.

- Ability to work independently and collaboratively in a fast-paced, dynamic environment, with a strong attention to detail and ability to manage multiple projects simultaneously.

- Passion for transformative projects and a commitment to advancing environmental and social well-being in Africa.

- Project Evaluation: Analyze potential investment opportunities in sustainable projects across various sectors, including renewable energy, infrastructure development, and sustainable agriculture.

- Financial Modeling: Develop financial models to assess project economics, including revenue projections, cost estimates, cash flow analysis, and investment returns.

- Due Diligence: Conduct comprehensive due diligence on potential investments, including market research, competitive analysis, regulatory review, and risk assessment.

- Investment Memos: Prepare investment memos and presentations summarizing key findings, investment thesis, and recommendations for review by senior management and investment committees.

- Partner Engagement: Collaborate with partner companies, stakeholders, and industry experts to gather relevant information, validate assumptions, and assess project viability and impact.

- Deal Structuring: Assist in structuring investment transactions, negotiating terms, and drafting investment agreements to ensure alignment with the organization's investment objectives and risk appetite.

- Portfolio Management: Monitor the performance of existing investments, track key performance indicators, and provide periodic updates and reports to stakeholders.

- Market Intelligence: Stay informed about industry trends, policy developments, and emerging opportunities in the impact investment space sector, providing insights to inform investment strategies and decision-making.

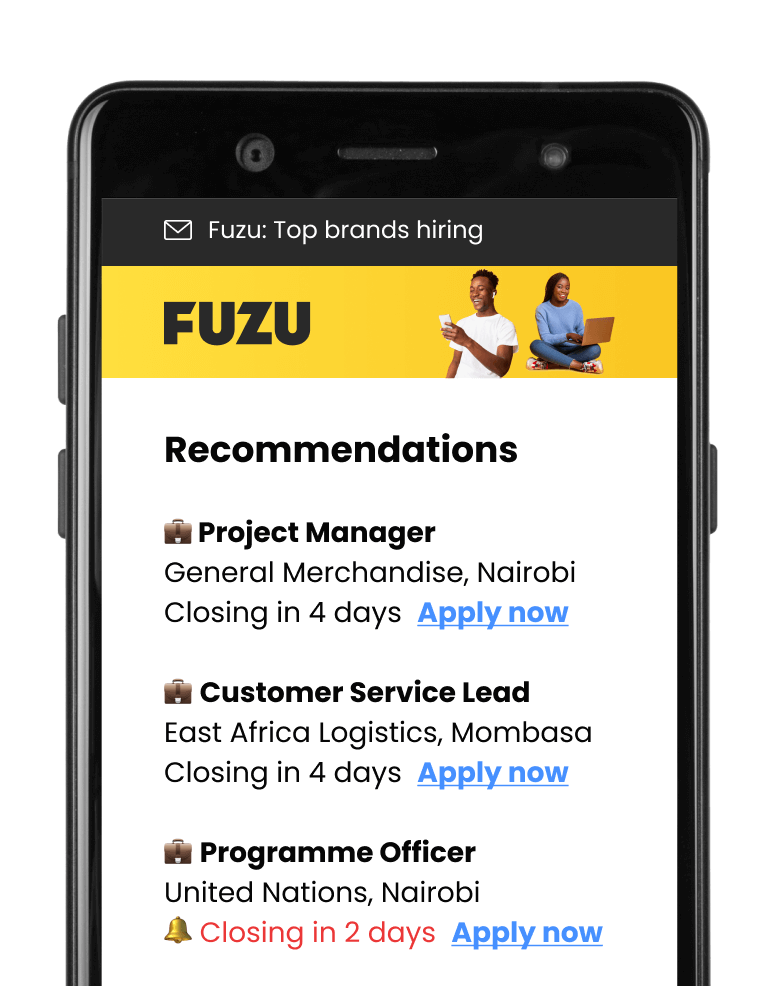

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.