Published

Last 1 week

Last 30 days

Latest 24 hours

Profession

Published

Profession

Industry

Seniority

26

jobs

NCBA

Kampala, Uganda

White Labelled Employer

Fast Apply

Fast ApplyKampala, Uganda

Standard Bank Group

Kampala, Uganda

ABC Capital Bank Uganda

Kampala, Uganda

Finance Trust Bank

Kampala, Uganda

Standard Chartered Bank

Kampala, Uganda

Standard Bank Group

Kampala, Uganda

Yako Bank LTD

Kampala, Uganda

ICEA Lion

Kampala, Uganda

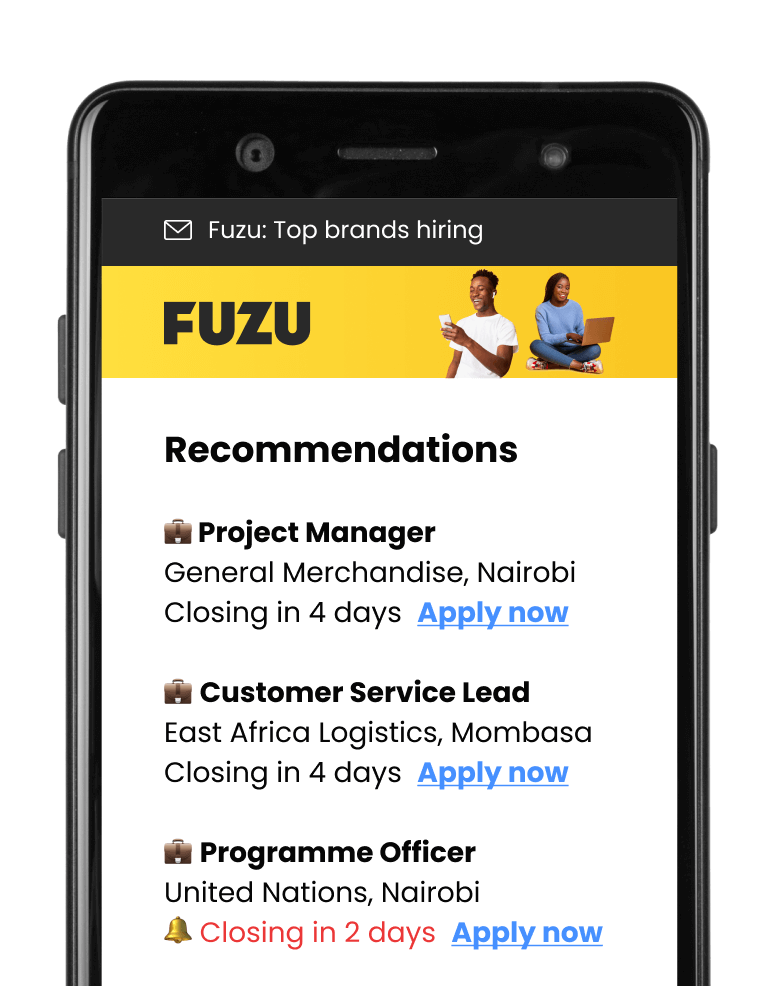

Get personalised job alerts directly to your inbox!

Old Mutual

Kampala, Uganda

Closing: Jul 6, 2024

Closing todayPublished: Jun 21, 2024 (16 days ago)

Education:

Work experience:

Language skills:

Contract Type:

Sign up to view job details.

The Branch Manager will provide powerful branch and its agency (ies) (hereinafter called “branch”)) leadership, team development, excellent customer experience, deliver exceptional branch business growth & profitability.

Responsible for the day-to-day running of the branch, keeping high level of bank operations standards and management controls.

Qualifications, Skills and Experience:

Academic:

Professional:

Desired work experience:

The Branch Manager will provide powerful branch and its agency (ies) (hereinafter called “branch”)) leadership, team development, excellent customer experience, deliver exceptional branch business growth & profitability.

Responsible for the day-to-day running of the branch, keeping high level of bank operations standards and management controls.

Qualifications, Skills and Experience:

Academic:

Professional:

Desired work experience:

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.