Closing: Jul 31, 2024

2 months remainingPublished: Jun 25, 2024 (5 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

Requirements

- Bachelor's Degree in Accounting or other discipline from a reputable University

- MBA or M.Sc. will be an added advantage

- Relevant professional qualifications such as ICAN, ACCA, CIS, CIA, ACA, CIBN MCP certified

- 5+ years of internal audit &/or external auditing experience in a reputable organization.

- Prior experience working in a Fintech or payment services firm; Big 4 professional service firm; banking or other financial services firms, technology firms, etc will be an advantage.

- Application of best practice audit standards and latest audit techniques, and tools

- Experience in data analytics and continuous auditing will be an added advantage

- Demonstrable knowledge of fraud schemes and indicators.

- Application of leading internal audit standards, risk management, and control methodologies.

- International Professional Practice Framework IPPF.

- Business Processes.

- Accounting standards (IFRS)

- Data Analytics skills

- Excellent communication skills – verbal, written, and presentation.

- Critical thinking and attention to detail.

Responsibilities

Requirements

- Bachelor's Degree in Accounting or other discipline from a reputable University

- MBA or M.Sc. will be an added advantage

- Relevant professional qualifications such as ICAN, ACCA, CIS, CIA, ACA, CIBN MCP certified

- 5+ years of internal audit &/or external auditing experience in a reputable organization.

- Prior experience working in a Fintech or payment services firm; Big 4 professional service firm; banking or other financial services firms, technology firms, etc will be an advantage.

- Application of best practice audit standards and latest audit techniques, and tools

- Experience in data analytics and continuous auditing will be an added advantage

- Demonstrable knowledge of fraud schemes and indicators.

- Application of leading internal audit standards, risk management, and control methodologies.

- International Professional Practice Framework IPPF.

- Business Processes.

- Accounting standards (IFRS)

- Data Analytics skills

- Excellent communication skills – verbal, written, and presentation.

- Critical thinking and attention to detail.

- As an Internal Auditor, you will provide a systematic and disciplined approach to the effectiveness of risk management control and governance processes.

- You will be accountable for the examination and evaluation of organization processes, reporting findings back to management regarding possible improvements and corrections.

- Hence you must possess a thorough knowledge of accounting procedures and a sound judgement.

- You will assess the accuracy, timeliness, and relevance of management information, appraising the efficiency of established policies and procedures, and reviewing them in the light of changing circumstances while also ensuring that Internal Control checks are carried out on all transactions.

Duties

- Supervise and or conduct periodic reviews of the corporate departments and submit reports on same in accordance with the approved audit plan, policies, processes, and audit manuals

- Coordinate the planned audits to ensure targets as met as intended.

- Advise on the adequacy and effectiveness of management controls over those activities based on levels of exceptions observed in the periodic audits.

- Participate in the periodic external or internal/training of the bank.

- Carry out special investigations as may be directed by the HOD and management.

- Provide assistance to external auditors and regulatory bodies as requested.

- Special duties and projects as may be assigned.

- Carry out fixed assets and stock of stationery review of the bank for cost control or reduction.

- Conduct periodic spot checks on branches and departments and submit reports on the exercise.

- Supervise and support members of the audit team during and after the audit exercise.

- Ensure efficiency and high-quality work in audit exercises.

- Ensure that the unit maintains up-to-date and accurate records of audit reports and performance evaluations.

- Participate in the periodic review of the audit manual/program.

- Carry out periodic or annual performance appraisals of assigned staff.

- Mentored, coached, trained, and hand-held staff under his supervision.

- Any other assignment as assigned by the CEO or the Board of Directors

Compliance:

- Establish and maintain a Compliance Program to ensure the company's compliance with applicable laws, regulations, and guidelines

- Implement effective monitoring systems to ensure regulatory compliance of the company

- Identify gaps and provide compliance training to management and internal staff to address any gaps that may affect the business operations

- Act as the key liaison with relevant regulatory authorities

- Follow-up to determine the adequacy of corrective actions.

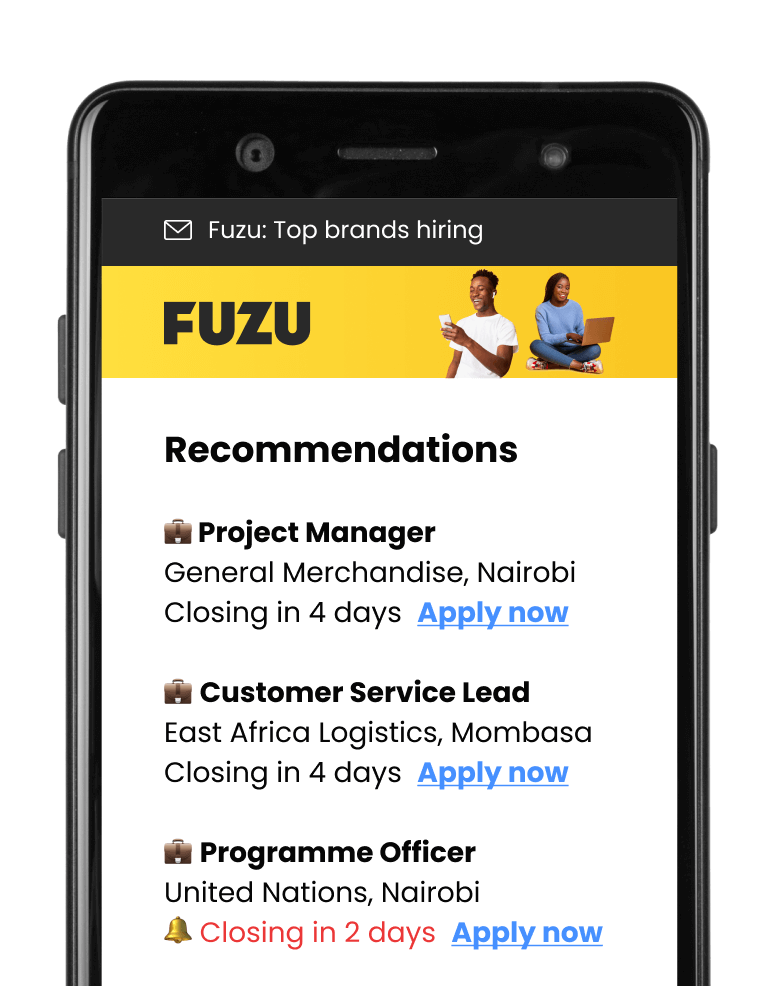

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.