Closing: Jul 8, 2024

2 days remainingPublished: Jun 27, 2024 (10 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

- The role holder will be responsible for establishing and maintaining strong relationships with our Chinese clients which will translate into revenue and growth for the bank.

The growth metrics measured include:

- Portfolio growth

- Growth in Product Per Client

- Increase in revenue per client

- Growth in number of clients

- Revenue growth

- Cost Management

- Service Excellence

- Operational Excellence and Compliance

Qualification

- CISI Level 2

- Bancassurance Certification

- Knowledge of Chinese Language Mandatory

Role Specific Technical Competencies

- Multi Product Knowledge

- Market and Competition Knowledge

- Soft Skills tailored to engage Affluent Clients

- Communication and Presentation Skills

- Negotiation and Objection Handling

- Problem Solving Skills

Responsibilities

- The role holder will be responsible for establishing and maintaining strong relationships with our Chinese clients which will translate into revenue and growth for the bank.

The growth metrics measured include:

- Portfolio growth

- Growth in Product Per Client

- Increase in revenue per client

- Growth in number of clients

- Revenue growth

- Cost Management

- Service Excellence

- Operational Excellence and Compliance

Qualification

- CISI Level 2

- Bancassurance Certification

- Knowledge of Chinese Language Mandatory

Role Specific Technical Competencies

- Multi Product Knowledge

- Market and Competition Knowledge

- Soft Skills tailored to engage Affluent Clients

- Communication and Presentation Skills

- Negotiation and Objection Handling

- Problem Solving Skills

- Engaging and deepening activities

- Methodically engage (remote)

- Have complete knowledge of the clients in terms of the profile & assets

- Create analytics-backed conversation

- Engage clients through the digital channels (calls, virtual meetings, webinars, email)

- Needs/Achor Products; Individual banking products (PL, CASA etc), Wealth Products

- Meet & deep sell (remote)

- Develop a comprehensive Account Plan for at least 20% of client base

- Meet virtually to meet advisory needs (once a quarter)

- Connect client with specialists

- Connect for periodic CDD reviews

- Conduct fulfillment & activate

- Refer most servicing activities to Client Service Managers

Acquiring on referrals

- Explain proposition & requirements in full

- Meet, deep sell & train (in person)

- Meet, listen and determine further needs

- Set up anchor products & initiate cross-sell

- Conduct/connect for CDD

- Educate and conduct initial set up for online, ATMs, Client Centre

Regulatory & Business Conduct

- Display exemplary conduct and live by the groups values and code of conduct

- Take personal responsibility for embedding the highest standards of ethics, including regulatory and business conduct, across Standard Chartered Bank. This includes understanding and ensuring compliance with, in letter and spirit, all applicable laws, regulations, guidelines and the Group Code of Conduct.

- Effectively and collaboratively identify, escalate, mitigate and resolve risk, conduct and compliance matters.

Key Stakeholders

- Product Specialists

- Client Service Manager, Affluent

- CDD team

- Branch Manager

- Product Managers

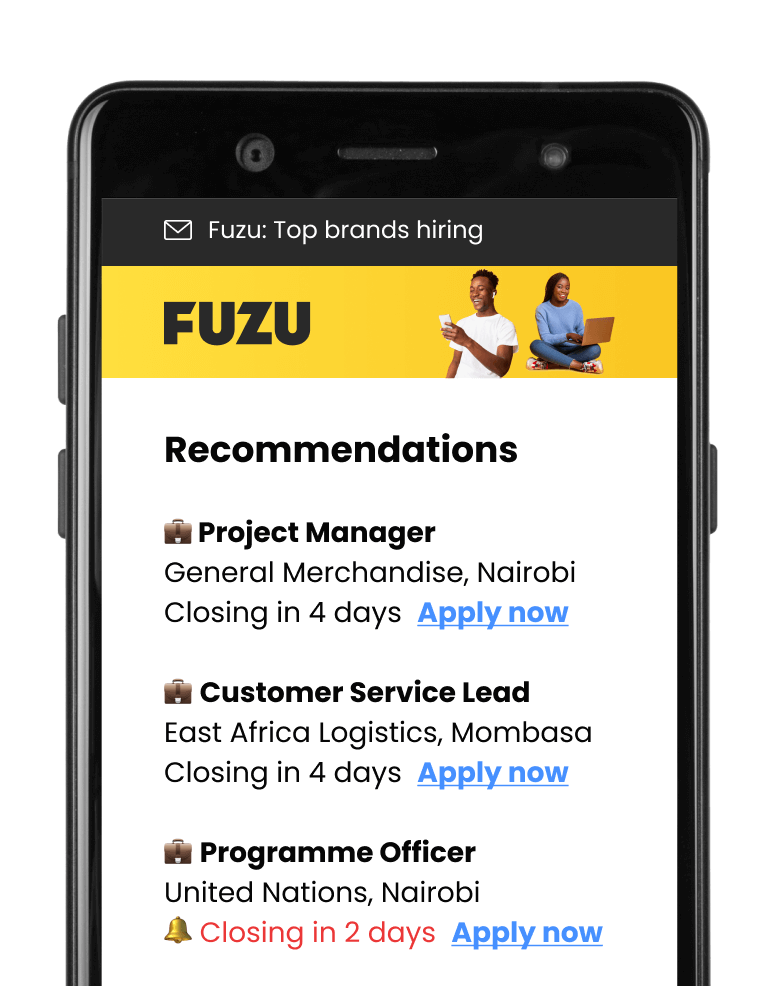

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.