Closing: Jun 28, 2024

This position has expiredPublished: Jun 18, 2024 (11 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

QUALIFICATIONS

- University Degree in Business Administration, Economics, Finance, Banking or its equivalent from a recognized institution.

- Possession of Postgraduate Qualifications in a relevant field from a recognized institution/ Professional Banking qualifications that are Credit/Risk Related including CPA, ACCA, AKIB, CIMA etc. will be an added advantage.

- A solid background in corporate credit, minimum 7 years at decision making level, preferably with a track record of operating with a personal delegated authority in corporate environment.

- Minimum 5 years’ experience in the application of extensive credit management, preferably in a Corporate and Investment Banking environment with proven ability to understand businesses, funding, and capital management issues.

- Ability to collate and compile appropriate set of financial and business information to quantify and evaluate the risks and benefits of a business proposal

- Ability to establish the risk profile of a counterparty and incorporate contextual industry risks in a credit application.

- Working knowledge of risk analysis and risk monitoring in particular the analysis of financial behaviour of businesses, identification of trends and shifts in credit risk profiles of business

- Practical understanding of bank’s products and lending facilities that give rise to counter party credit risk .

- The ability and confidence to operate and make decisions independently whilst still operating as an effective team player .

Responsibilities

QUALIFICATIONS

- University Degree in Business Administration, Economics, Finance, Banking or its equivalent from a recognized institution.

- Possession of Postgraduate Qualifications in a relevant field from a recognized institution/ Professional Banking qualifications that are Credit/Risk Related including CPA, ACCA, AKIB, CIMA etc. will be an added advantage.

- A solid background in corporate credit, minimum 7 years at decision making level, preferably with a track record of operating with a personal delegated authority in corporate environment.

- Minimum 5 years’ experience in the application of extensive credit management, preferably in a Corporate and Investment Banking environment with proven ability to understand businesses, funding, and capital management issues.

- Ability to collate and compile appropriate set of financial and business information to quantify and evaluate the risks and benefits of a business proposal

- Ability to establish the risk profile of a counterparty and incorporate contextual industry risks in a credit application.

- Working knowledge of risk analysis and risk monitoring in particular the analysis of financial behaviour of businesses, identification of trends and shifts in credit risk profiles of business

- Practical understanding of bank’s products and lending facilities that give rise to counter party credit risk .

- The ability and confidence to operate and make decisions independently whilst still operating as an effective team player .

- Evaluation of credit appetite including appropriateness of structure considering application, tenor, risk versus return relationship, and the evaluation of effectiveness of risk mitigants.

- Analysis of credit applications to assess whether the credit risk is in line with the Bank’s Credit Appetite and relative to the profitability of the deal.

- Coordination and management of the credit origination and evaluation process to meet acceptable turnaround times.

- Support the Corporate business units to deliver world class service to external customers by assisting in negotiating term sheets with clients to ensure that the deal structure, conditions, and covenants conform to the overall credit requirements of the bank.

- Achieve 100% compliance with lending policy guidelines and other governance requirements

- Deliver well thought out decisions showing sound judgement where applications are within delegated sanctioning authority.

- Managing credit risk through measurement of the distribution of actual and expected credit losses, sector concentration and credit risk migration-based probability of default, exposure at default and loss given default parameters.

- Making recommendations to the Credit and Business teams regarding industry trends and the implications for managing the credit facilities of clients in those industries.

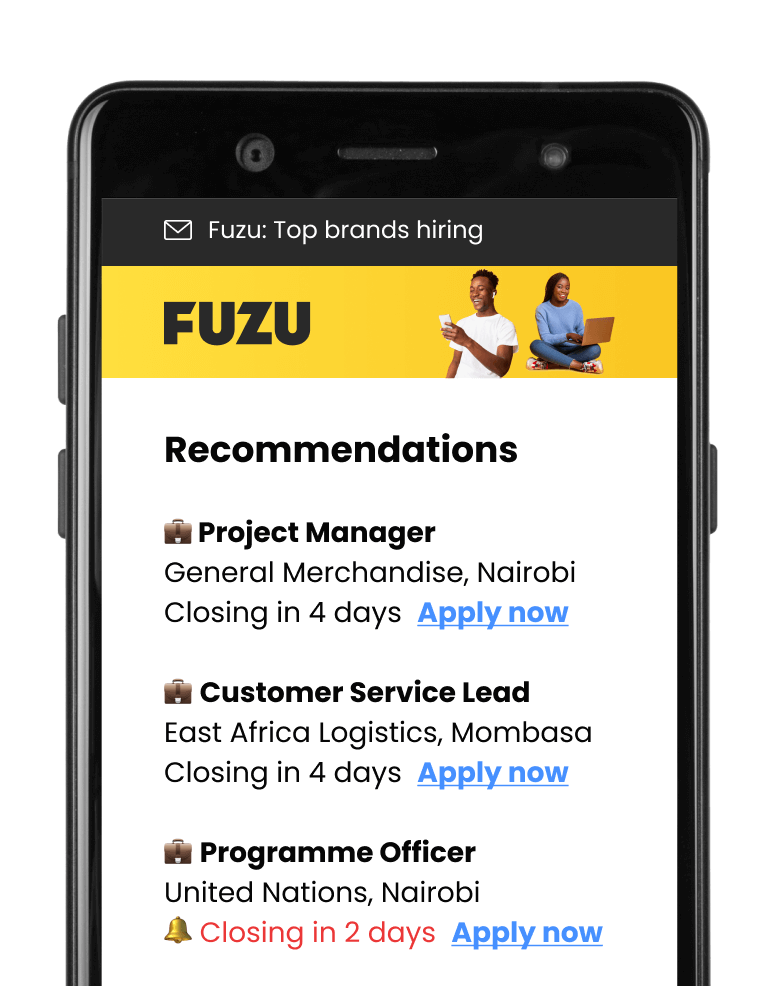

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.