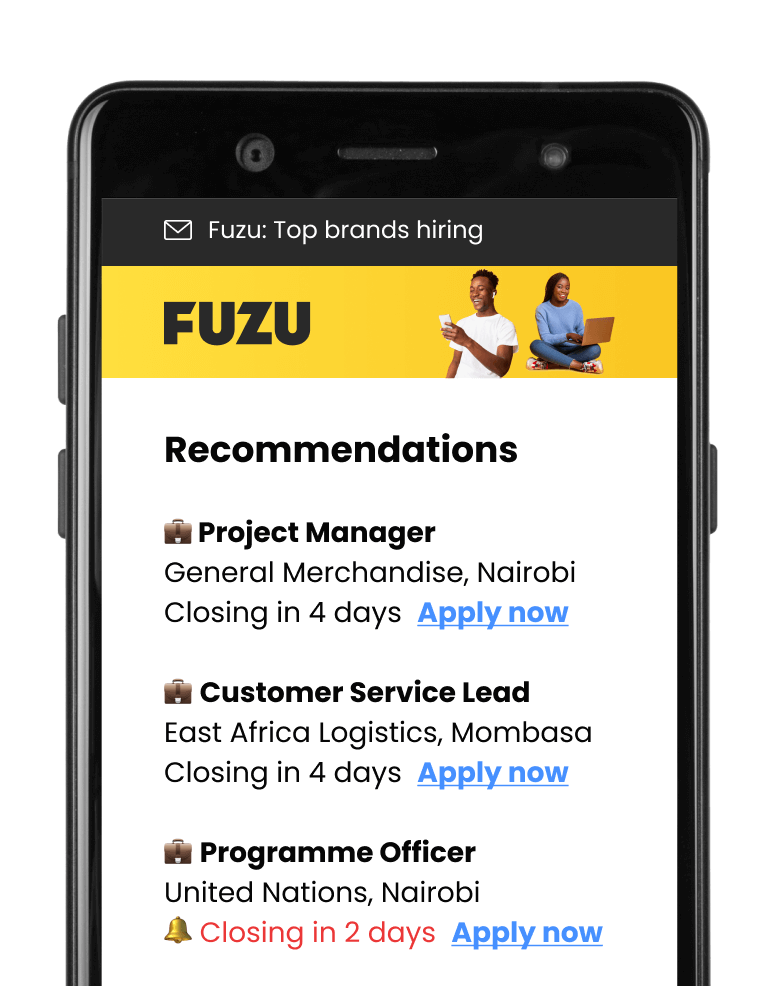

Closing: Jul 10, 2024

4 days remainingPublished: Jun 28, 2024 (9 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

ACADEMIC AND PROFESSIONAL QUALIFICATIONS AND KNOWLEDGE

- Bachelor Degree in Engineering or related discipline from a reputable university.

- Professional qualification(s) in insurance e.g. Enterprise Risk Management (EIA), Environmental Impact Assessment and Audit (EIA) ,

- Occupation Health and Safety (OSH), ACII, FCII or equivalent.

EXPERIENCE

- At least three (3) years of relevant experience in a reputable insurance company.

CORE TECHNICAL COMPETENCIES REQUIRED FOR THE ROLE

- Ability to put together accurate schedules of work.

- Superior computer literacy in order to use the equipment and systems required for the job role.

- Ability to make predictions on frequency and costs of insurance claims.

- Ability to analyse and interpret insurance risk profiles.

- High level interpersonal and cross-cultural skills, including ability to build alliances and collaborative relationships with sensitivity to diversity.

- Must be a self-starter, highly organized, and able to work well with people at all levels in the organization.

- High levels of integrity.

- Strategic thinking and problem-solving skills.

Responsibilities

ACADEMIC AND PROFESSIONAL QUALIFICATIONS AND KNOWLEDGE

- Bachelor Degree in Engineering or related discipline from a reputable university.

- Professional qualification(s) in insurance e.g. Enterprise Risk Management (EIA), Environmental Impact Assessment and Audit (EIA) ,

- Occupation Health and Safety (OSH), ACII, FCII or equivalent.

EXPERIENCE

- At least three (3) years of relevant experience in a reputable insurance company.

CORE TECHNICAL COMPETENCIES REQUIRED FOR THE ROLE

- Ability to put together accurate schedules of work.

- Superior computer literacy in order to use the equipment and systems required for the job role.

- Ability to make predictions on frequency and costs of insurance claims.

- Ability to analyse and interpret insurance risk profiles.

- High level interpersonal and cross-cultural skills, including ability to build alliances and collaborative relationships with sensitivity to diversity.

- Must be a self-starter, highly organized, and able to work well with people at all levels in the organization.

- High levels of integrity.

- Strategic thinking and problem-solving skills.

- Inspecting properties, items, and operations of establishments to assess physical condition, housekeeping, and work practices.

- Collating and assessing risk information on site; and using templates to record assessments and collecting photographic evidence.

- Preparing detailed, comprehensive, and accurate risk survey reports as per the company’s requirements.

- Preparing risk improvement recommendations/ loss prevention reports.

- Protecting the interests of the company by conducting comprehensive and accurate risk surveys and reports in order to provide underwriters with adequate information to underwrite acceptable business correctly, which ultimately ensures profitability.

- Pointing out to underwriters the possible financial risk posed by offering insurance cover for items, properties or sites inspected.

- Advising clients on-site and discussing opportunities and requirements to reduce the level of risk, or introducing the need for risk improvement.

- Accompanying underwriters and business development staff on-site visits to help them understand the practicalities of the site/risk.

- Liaising with other professionals, e.g. underwriters, brokers, client representatives, inspectors of health and safety and fire officers about risk improvement measures at insured’s sites as necessary.

- Keeping up to date with technical aspects affecting risks, e.g. trade processes, legislation, hazardous materials.

- Developing and promoting safety programs in relation to sites/property inspected.

- Acting as a technical point of referral, provides information and training, where necessary, to support and develop the skills and knowledge of the underwriting and claims teams.

- Identifying cases of underinsurance and covers and makes appropriate recommendations to clients, brokers and underwriters.

- Accompanying external risk surveyors, the company may appoint to survey risks as necessary.

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.