Closing: Jul 15, 2024

9 days remainingPublished: Jun 21, 2024 (16 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

QUALIFICATIONS AND EXPERIENCE

- University Degree preferably in a Business-related field.

- Atleast 3 years working experience as a Credit Officer handling MSME clients in financial institutions(Sacco/Microfinance/Bank)

- Solid analytical skills and experience in credit appraisal, handling, and resolving customer requests and queries.

- Good understanding of prudential guidelines and KYC.

- Strong communication and team-building skills with ability to work with diverse teams.

- Resilient, confident and self-motivated.

Interested candidates who meet the set criteria may submit their Application Letter together with their detailed CV, Copy of I.D, Copies of Academic & Professional Certificates, Names and Contacts of three referees to [email protected] clearly indicating the position applied for with the job reference number on or before July 15th 2024.

Applications that are incomplete, received after the due date or that do not meet the stated requirements will not be considered. Hard Copy Documents will not be accepted. Canvassing Will Lead to Automatic Disqualification. Only Shortlisted Candidates Will Be Contacted.

THE SUCCESSFUL CANDIDATE MUST FULFILL THE REQUIREMENTS OF CHAPTER SIX OF THE CONSTITUTION OF KENYA 2010 BELOW:

- Valid Certificate of Good Conduct from the Directorate of Criminal Investigations

- Clearance Certificate from the Higher Education Loans Board/Compliance Certificate

- Tax Compliance Certificate from KRA

- Clearance from Ethics and Anti-Corruption Commission

- A Clearance Certificate from an approved Credit Reference Bureau CRB

Responsibilities

QUALIFICATIONS AND EXPERIENCE

- University Degree preferably in a Business-related field.

- Atleast 3 years working experience as a Credit Officer handling MSME clients in financial institutions(Sacco/Microfinance/Bank)

- Solid analytical skills and experience in credit appraisal, handling, and resolving customer requests and queries.

- Good understanding of prudential guidelines and KYC.

- Strong communication and team-building skills with ability to work with diverse teams.

- Resilient, confident and self-motivated.

Interested candidates who meet the set criteria may submit their Application Letter together with their detailed CV, Copy of I.D, Copies of Academic & Professional Certificates, Names and Contacts of three referees to [email protected] clearly indicating the position applied for with the job reference number on or before July 15th 2024.

Applications that are incomplete, received after the due date or that do not meet the stated requirements will not be considered. Hard Copy Documents will not be accepted. Canvassing Will Lead to Automatic Disqualification. Only Shortlisted Candidates Will Be Contacted.

THE SUCCESSFUL CANDIDATE MUST FULFILL THE REQUIREMENTS OF CHAPTER SIX OF THE CONSTITUTION OF KENYA 2010 BELOW:

- Valid Certificate of Good Conduct from the Directorate of Criminal Investigations

- Clearance Certificate from the Higher Education Loans Board/Compliance Certificate

- Tax Compliance Certificate from KRA

- Clearance from Ethics and Anti-Corruption Commission

- A Clearance Certificate from an approved Credit Reference Bureau CRB

JOB REF: YSL/CRO/2024ROLES AND RESPONSIBILITIESFINANCIAL: 50%

- Credit Application file set up and follow up.

- Collect and analyze customers or prospect financial statements and other documents.

- Analysis and preparation of credit facility application files, and adherence to pricing conditions negotiated, within set SLAs after receipt of all the documents from the customers.

- Identify opportunities to cross sell the Sacco’s various products.

- Ensure full compliance with the Sacco’s Credit Policy.

CUSTOMER FOCUS: 30%

- Managing the loan portfolio.

- Analysis of the real needs of the customer and check consistency of requested and proposed facilities.

- Ensure retention of clients while enriching and updating prospect databases.

- Identify opportunities to meet customer needs and for cross selling.

- Follow up on customer complaints and ensure delivery within Service Level Agreements and procedures.

- Scheduled focused calls to customers to contribute to continuous improvement of customer relationships.

OPERATIONAL: 20%

- Counterparty Risk Contribution: Update time schedules of customer files: KYC information, call reports, maturities, completion of security documentation, insurances, rates and loan installment arrears.

- Ensuring adherence to the regulatory compliance and implementation of effective anti-money laundering procedures controls.

- Ensuring initiation of MOUs with reputable organizations.

- Strict adherence to the Sacco’s Code of Ethics in all customer dealings.

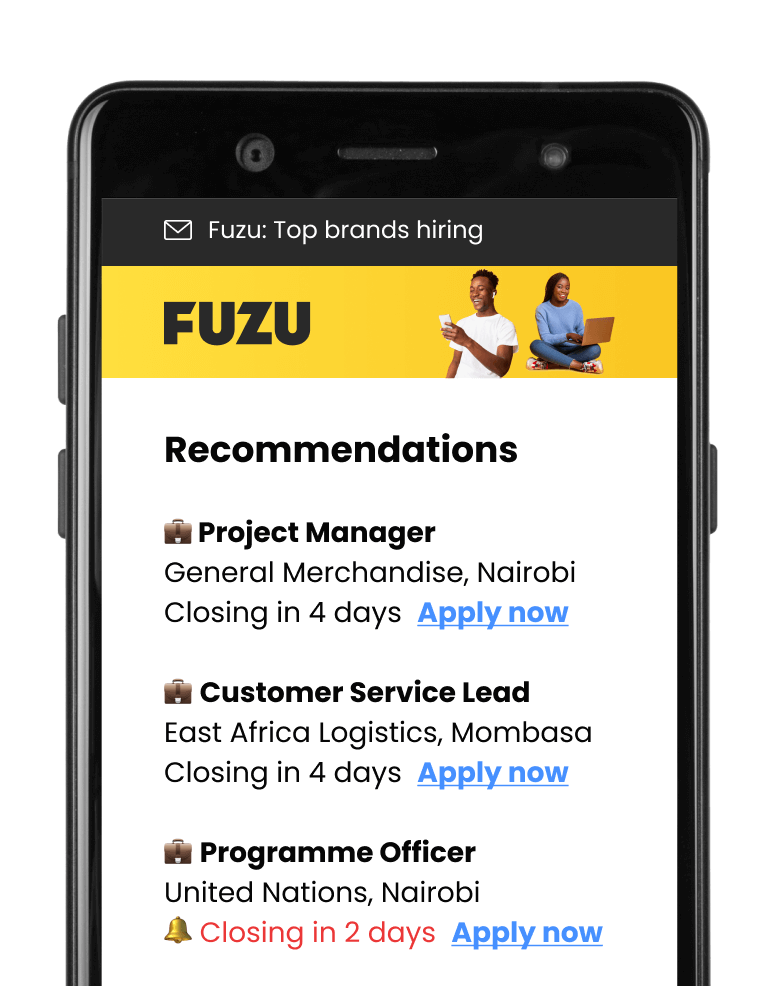

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.