Published

Profession

Industry

Seniority

Published

Profession

Industry

Seniority

0

jobs

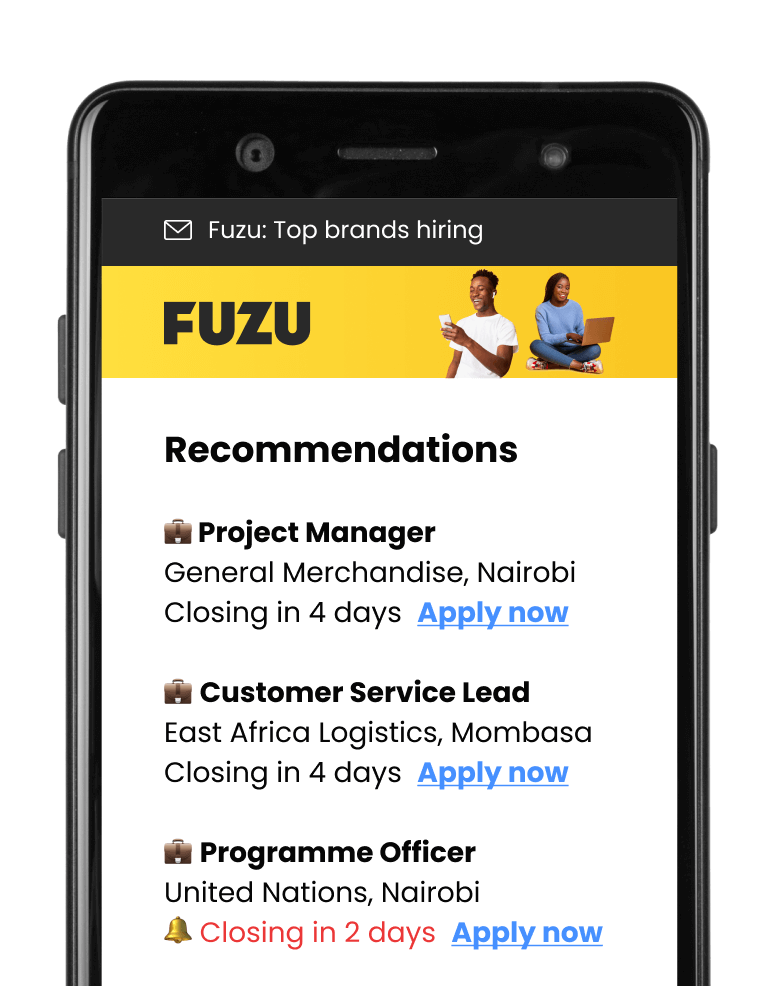

Get personalised job alerts directly to your inbox!

United Bank for Africa Plc

CLOSEDFort Portal, Uganda

Closing: Jun 12, 2024

This position has expiredPublished: Jun 6, 2024 (31 days ago)

Education:

Work experience:

Language skills:

Contract Type:

Sign up to view job details.

Requirements

a) A University degree holder from a reputable university.

b) A financial qualification or associate such as CIB, IOS, CFA, ACCA etc and MBA would be an added advantage.

c) Experience 5-10 years’ experience in retail/private banking

Requirements

a) A University degree holder from a reputable university.

b) A financial qualification or associate such as CIB, IOS, CFA, ACCA etc and MBA would be an added advantage.

c) Experience 5-10 years’ experience in retail/private banking

a) Increase customer retention and growth through an aggressive cross sell of the bank relevant financial products and thereby promote an optimum build-up of revenue.

b) Conduct market intelligence and competitor analysis in order to develop, and implement Branch Business strategies and plans with an objective of identifying business opportunities and financial products generation to enable achievement of targeted growth objectives in line with the Retail business plan.

c) Build tools/programs/mechanisms of effective relationships with new and existing customers by establishing customer needs and attending to the suitability of services to ensure effective and timely customer service delivery according to prescribed SLAs.

d) Build, develop and motive high performance team committed to achieving success through coaching and mentoring the team and providing technical support and leadership to ensure that the team achieves and surpasses the target

e) Recommend development of various products based on customer’s feedback and contribute to the effective launching of new products to ensure favorable market response and optimum build-up of revenue through sales campaigns

f) Review and evaluate new and renewal lending proposals, negotiating terms with customers and, where appropriate, submitting proposals to the credit department for approval;

g) Drive adherence to the banks /Regulatory Authorities’ policies and guidelines within the Branch

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.