Published

Last 1 week

Last 30 days

Latest 24 hours

Published

Profession

Industry

Seniority

4

jobs

Rosabon Financial Services Limited

Ondo, Nigeria

The Alliance For International Medical Action (ALIMA)

Ondo, Nigeria

Malaria Consortium

Ondo, Nigeria

The Alliance For International Medical Action (ALIMA)

Ondo, Nigeria

Salpha Energy Limited

CLOSEDOndo, Nigeria

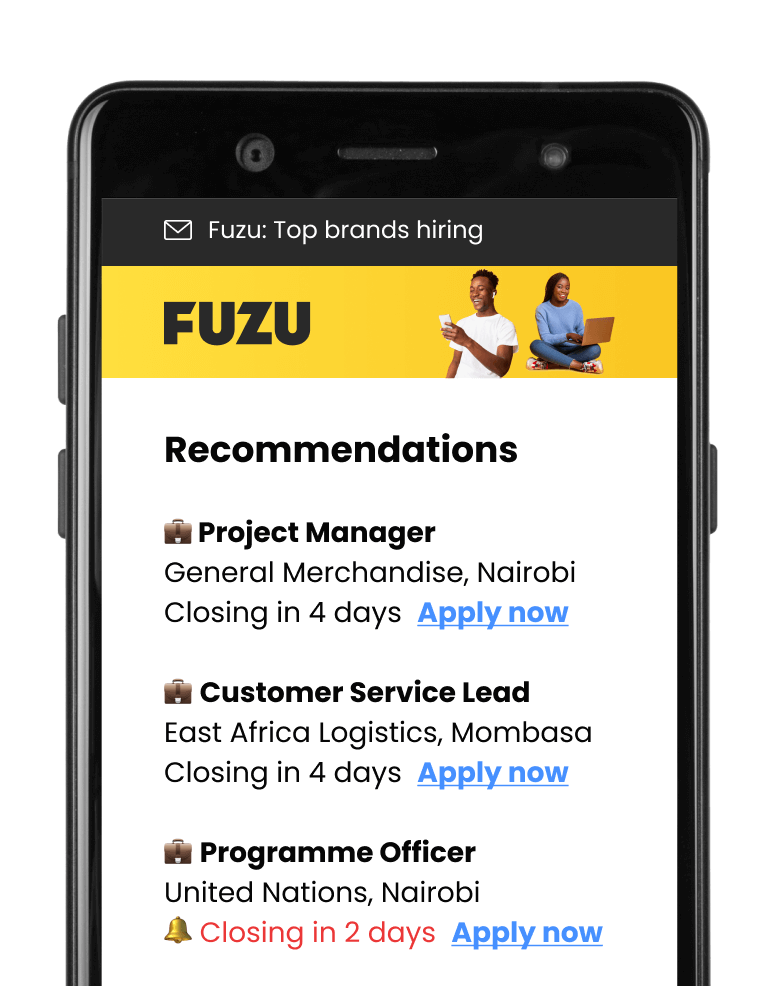

Get personalised job alerts directly to your inbox!

Ascentech Services Limited

CLOSEDOndo, Nigeria

Closing: Jul 19, 2024

13 days remainingPublished: Jun 19, 2024 (18 days ago)

Education:

Work experience:

Language skills:

Contract Type:

Sign up to view job details.

Scope and Impact

Job Summary

Duties & Duties

Key Performance Indicators:

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.