Published

Last 1 week

Last 30 days

Latest 24 hours

Profession

Seniority

Published

Profession

Industry

Seniority

0

jobs

Fairmoney Nigeria

CLOSEDAbuja, Nigeria

World Bank Group

CLOSEDAbuja, Nigeria

Wema Bank Plc

CLOSEDAbuja, Nigeria

Wema Bank Plc

CLOSEDAbuja, Nigeria

Wema Bank Plc

CLOSEDAbuja, Nigeria

Wema Bank Plc

CLOSEDAbuja, Nigeria

Wema Bank Plc

CLOSEDAbuja, Nigeria

Wema Bank Plc

CLOSEDAbuja, Nigeria

Wema Bank Plc

CLOSEDAbuja, Nigeria

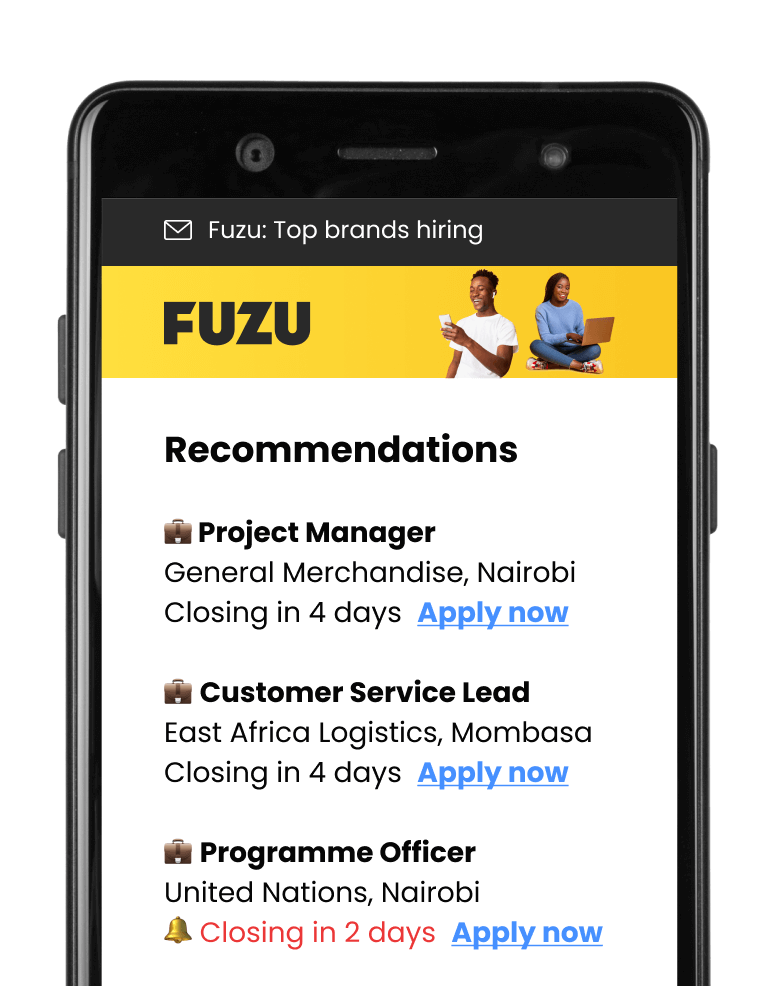

Get personalised job alerts directly to your inbox!

Wema Bank Plc

CLOSEDAbuja, Nigeria

Closing: Jun 11, 2024

This position has expiredPublished: May 27, 2024 (2 months ago)

Education:

Work experience:

Language skills:

Contract Type:

Sign up to view job details.

Roles and Duties

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.