Closing: Jul 5, 2024

This position has expiredPublished: Jul 2, 2024 (5 days ago)

Job Requirements

Education:

Work experience:

Language skills:

Job Summary

Contract Type:

Sign up to view job details.

The Person

For the above position, the successful applicant should have the following:

- A University Degree in Actuarial Science, Accounting, Business Administration, Statistics, Economics, Mathematics, or any other relevant field

- ACI Dealing Certificate

- At least 6 years’ experience in Treasury Execution Management.

- At Least 5 years’ experience in Funds Transfer Price Modelling, Investment portfolio management, and Stakeholder Management.

- At Least 4 years’ experience in Capital Management and Senior Management Reporting.

- At Least 3 years’ experience in Banking/ Finance, Risk Management and People Management.

Responsibilities

The Person

For the above position, the successful applicant should have the following:

- A University Degree in Actuarial Science, Accounting, Business Administration, Statistics, Economics, Mathematics, or any other relevant field

- ACI Dealing Certificate

- At least 6 years’ experience in Treasury Execution Management.

- At Least 5 years’ experience in Funds Transfer Price Modelling, Investment portfolio management, and Stakeholder Management.

- At Least 4 years’ experience in Capital Management and Senior Management Reporting.

- At Least 3 years’ experience in Banking/ Finance, Risk Management and People Management.

- Ensure adherence to Group Capital Management policies and risk framework across the bank subsidiaries.

- Develop and implement capital plans and modelling templates for assessing capital ratios and requirements to deliver target risk weighted assets (RWA) growth for all KCB Group subsidiaries.

- Ensure adherence to the regulatory and internal capital requirements across the Group and set clear escalation guidelines for breaches.

- Manage the Group’s capital stress testing processes, working together with the Group Risk function to design scenarios, including macro-economic variables and paths, critical to understanding the Group’s capital exposures, risks and mitigations.

- Responsible for all Group capital applications (including SBL dispensations and guarantee applications) ensuring quality of applications and deliver board expectations by challenging and reviewing returns.

- Optimize funding strategies and funding plans to support market share growth, returns and cost reductions, engaging with in-country and Group TES function on wholesale funding market capacity and opportunities.

- Working with the Group Treasurer on the issuance of short-term and long-term funding instruments (where appropriate) - Secured funding (securitization); Unsecured funding (senior and subordinated capital)

- Provide guidelines on the appropriate design and structure of the benchmark investment portfolio for each subsidiary.

- Chair investment committees in subsidiary treasuries to optimize the sovereign investment strategies to enhance contribution to Group RoRC.

- Review Capital plans from bank subsidiaries monthly, clearly capturing the forecast regulatory capital demand and supply across business units over the 3-year planning horizon; Check and challenge to ensure the capital position on the capital plan over the planning cycles meets the board and regulatory approved targets.

- Determine capital buffers and perform Cost of Equity calculations in line with KCB Treasury principles and methodology.

- Oversight Risk Weighted Assets (RWA) optimization initiatives across Subsidiaries, challenging data inputs and engagement with in-country treasury teams to guide modelling capability.

- Work with in-country treasury teams in setting risk adjusted return hurdles and ensure that the hurdle rates are met by evaluating pricing tools and assumptions.

- Lead the BAU Basel regulatory change initiatives. This extends beyond RWA reporting to the consideration of moving from Standardized to advanced (engaging with the credit modelling teams as appropriate)

- Support the subsidiary Treasurers with Internal Capital Adequacy Assessment Plan (ICAAP) submissions to regulators; Coordinate the drafting and governance of Group ICAAP submission.

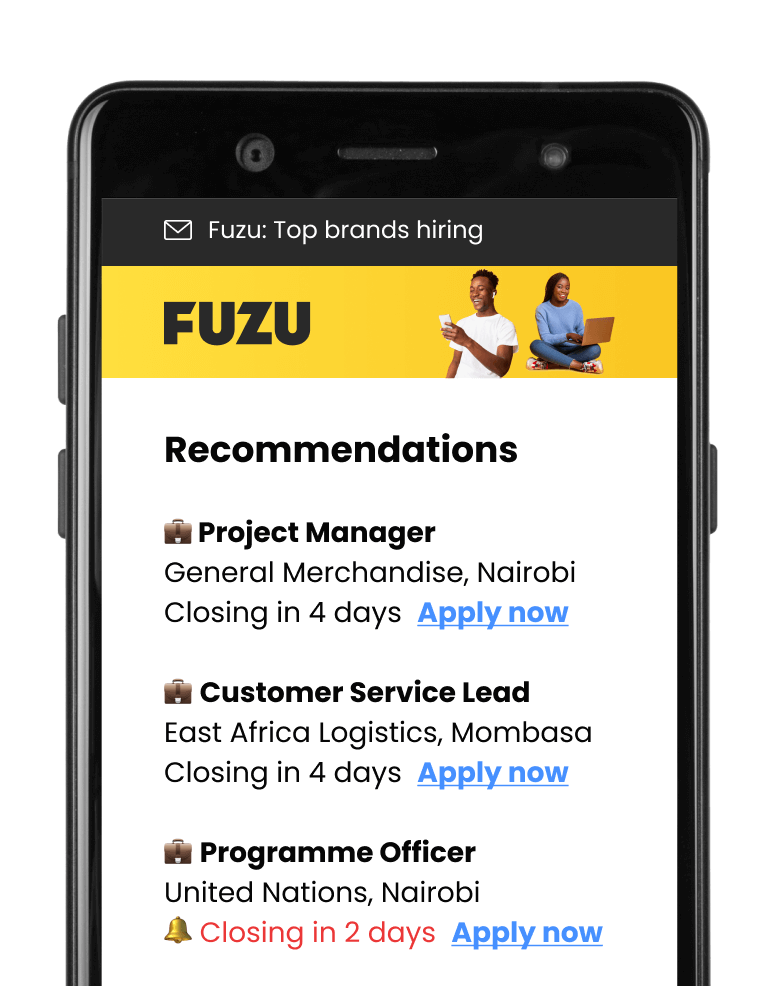

Applications submitted via Fuzu have 32% higher chance of getting shortlisted.